The tax year ends on 5th April and in keeping with the recent snowstorms, the financial press is a blizzard, not of snow, but of last minute end of tax year financial advice. However, the Sunday papers unimaginative annual ISA fund recommendations masquerade merely as promotions for their financial cohorts and I’m definitely not here to do that.

The Sunday papers unimaginative annual ISA fund recommendations masquerade merely as promotions for their financial cohorts

Instead, I’m going to explain just one sales free tax planning tip that I use with many of my clients every tax year. It’s my favourite tax planning tool as it’s easy to understand, completely above board, comes with significant tax savings when completed regularly over time and is something that investors generally don’t remember to do on their own. The annual use of the Capital Gains Tax (CGT) allowance.

For anyone investing a large lump sum, restrictions apply to the initial amount that can be invested in a tax-exempt account such as an Individual Savings Account (ISA) or pension. Invariably some investments must be held outside of these tax-free ‘wrappers’ and with time, realised capital gains (if any are made) are taxed at 20%* for a higher rate taxpayer (those with earned income exceeding £45,000).

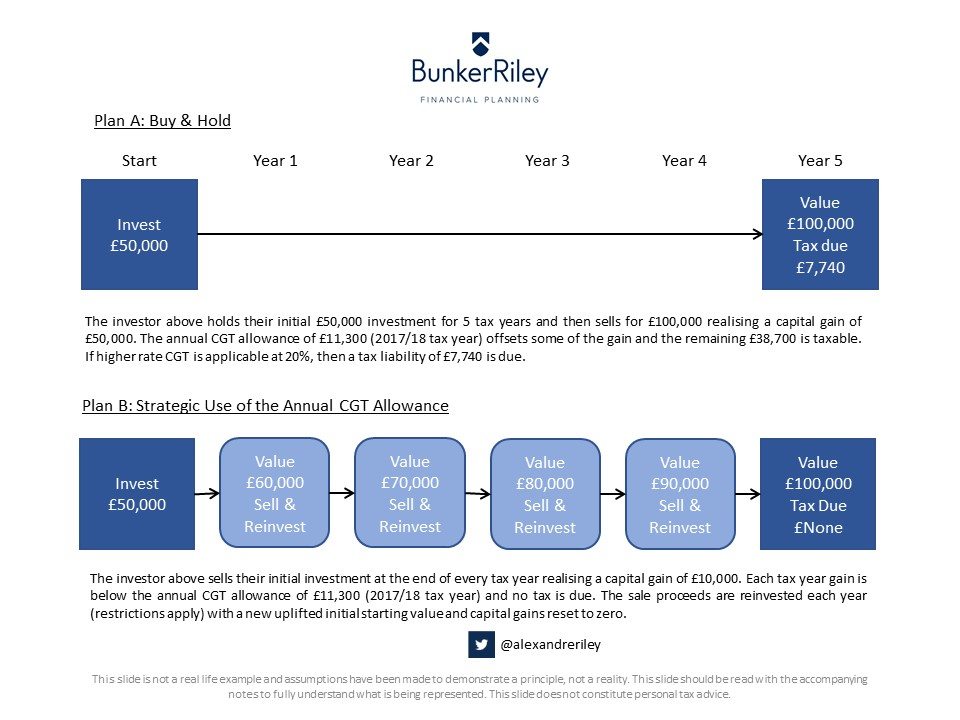

However, each and every tax year there is a CGT allowance (currently £11,300) which can be used to reduce the total gain on which the tax is calculated. For example, if you invest £50,000 in a taxable fund and it grows to £100,000 the gain on your original investment would be £50,000. On realisation of the gain (by selling the fund), some could be offset by the amount of the CGT allowance reducing the taxable gain to £38,700. A higher rate taxpayer would then be liable to CGT at 20% on this amount, equaling £7,740.

And that’s what most people do. They use their tax-free ISA or pension allowance, invest the overflowing amount into taxable funds, hold for multiple years, let the gains ride and eventually sell, realising a large capital gain with tax to pay on it. But there is a way to manage the tax position and this is where my favourite tax planning tip offers savings.

Instead of letting gains ride year after year, why not realise some of them each year by making use of the CGT annual allowance multiple times rather than just once, right at the end? In the following slide, you can see a comparison of an investor who simply buys and holds taxable funds as described earlier, to one who strategically sells their investment annually to realise a gain within the annual CGT allowance, immediately reinvesting the sale proceeds. Click to enlarge.

The slide is not intended to show the returns from an actual investment, but to demonstrate the principle of periodically selling a rising investment to realise a capital gain, tax-free, within the annual CGT allowance. Immediate reinvestment then locks in a new, higher starting investment value against which new future gains can be assessed. You effectively sold your investment and now hold a new one.

You can see that with careful and regular use of the CGT allowance, gains can be managed periodically to reduce future taxation on the final sale. There are of course restrictions to be aware of such as the inability to buy back the same investment within 30 days, but with thousands of investment funds available there are numerous investment alternatives. Likewise, the ability to sell and then reinvest into new tax year ISAs and pension allowances further improve the tax position. Gains made elsewhere on other investments and investment losses must also be taken into account, but these considerations are beyond the scope of this piece. Tax can be complicated and it should never be the main reason for investing, so always take professional advice.

Ultimately this is just one of many financial planning opportunities that are rarely covered in the mainstream press. Should the CGT allowance and highest CGT rate on funds remain at or near 20% in future tax years, an investor could feasibly save £22,600 in CGT over the course of 10 years (£11,300 allowance x 20% tax saved x 10 years) not to mention the potential additional returns on the tax savings if they are reinvested. Double that up for an investing spouse or partner and you’ll understand why every time I complete this process for a client I might share a few fist bumps.

Follow me on Twitter @AlexandreRiley

*Different CGT rates apply to property, trusts and Entrepreneurs. Tax rates, allowances and tax legislation change regularly and this blog should not be relied upon as accurate after 5th April 2018.