As we start the new decade, you may have taken some time to look back at the last ten years and consider how much has changed both personally and financially. You might even have thought about the next ten.

And after what has been a stellar recent decade for the global stock market1 with a total gain of 204% and an average annual return of just under 12%2, it might seem logical to ask the following question. With significantly higher valuations, is it safe to invest right now?

“With significantly higher valuations, is it safe to invest right now?”

If you thought investing your hard-earned money after such great recent returns would subject you to the ‘risk’ of an imminent crash, I would certainly understand. But it should only be a legitimate fear for short-term speculators and those needing access to a significant capital withdrawal in the next handful of years.

If you are or continue to be, a well-diversified, long-term investor with a multi-decade retirement plan, then I believe current investment valuations deserve little attention.

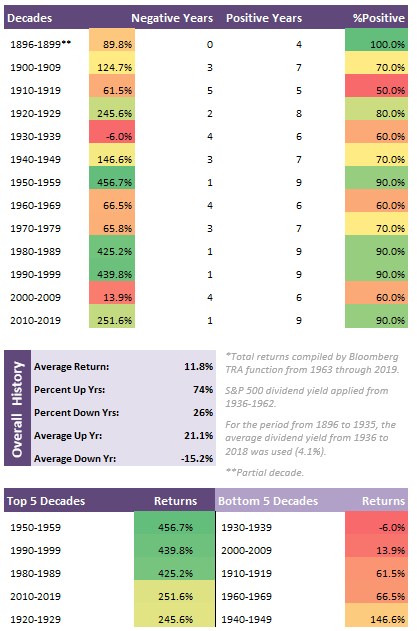

For example, this chart by Drew Dickson at Albert Bridge Capital provides cumulative decade performance for the US stock market. It shows that although 2010-19 has been good, has it really been that out of the ordinary or are we still scarred by our memory of 2000-2009?

That’s not to say there won’t be trouble ahead. But trying to avoid a temporary loss now could make you worse off in the long run by sitting on the sidelines waiting for an entry point. There’s a quip that goes “If you think stocks are expensive now, you should see them in twenty years.”

“If you think stocks are expensive now, you should see them in twenty years.”

Market Timing

So, I would hope that for those of you who know me, you’ve heard me speak consistently enough about the perils of ‘market timing’ (trying to get in or out of the market at the most opportune time).

If you’re unfamiliar please consider that most personal finance professionals conclude market timing is a game not worth playing, as explained HERE by the financial practitioner and author Ben Carlson. Note that Ben’s piece was written in 2013, at a time when some investors were already worried about valuations. And look where we are now! Case in point. Can you imagine sitting out since then and still be waiting for the ideal time to go for it?

The Best Time is Now

My own financial planning philosophy is aligned with the proverb “The best time to plant a tree was 20 years ago. The second-best time is now.”

“The best time to plant a tree was 20 years ago. The second-best time is now.”

This provides far better guidance to everyday investors like you and me who are considering whether it is safe to invest right now. Investing is not about market timing, forecasting short-term temporary losses, or trying to avoid stock market ‘volatility’. All of which the financial media portray as ‘risk’.

The real risk is the destructive effect of inflation over time and the inability to afford your financial goals in 10, 20, or 30 years from now, because you let your irrational need for safety today take priority over the real needs of your future self.

“The real risk is the destructive effect of inflation over time and the inability to afford your financial goals in 10, 20, or 30 years from now, because you let your irrational need for safety today take priority over the real needs of your future self.”

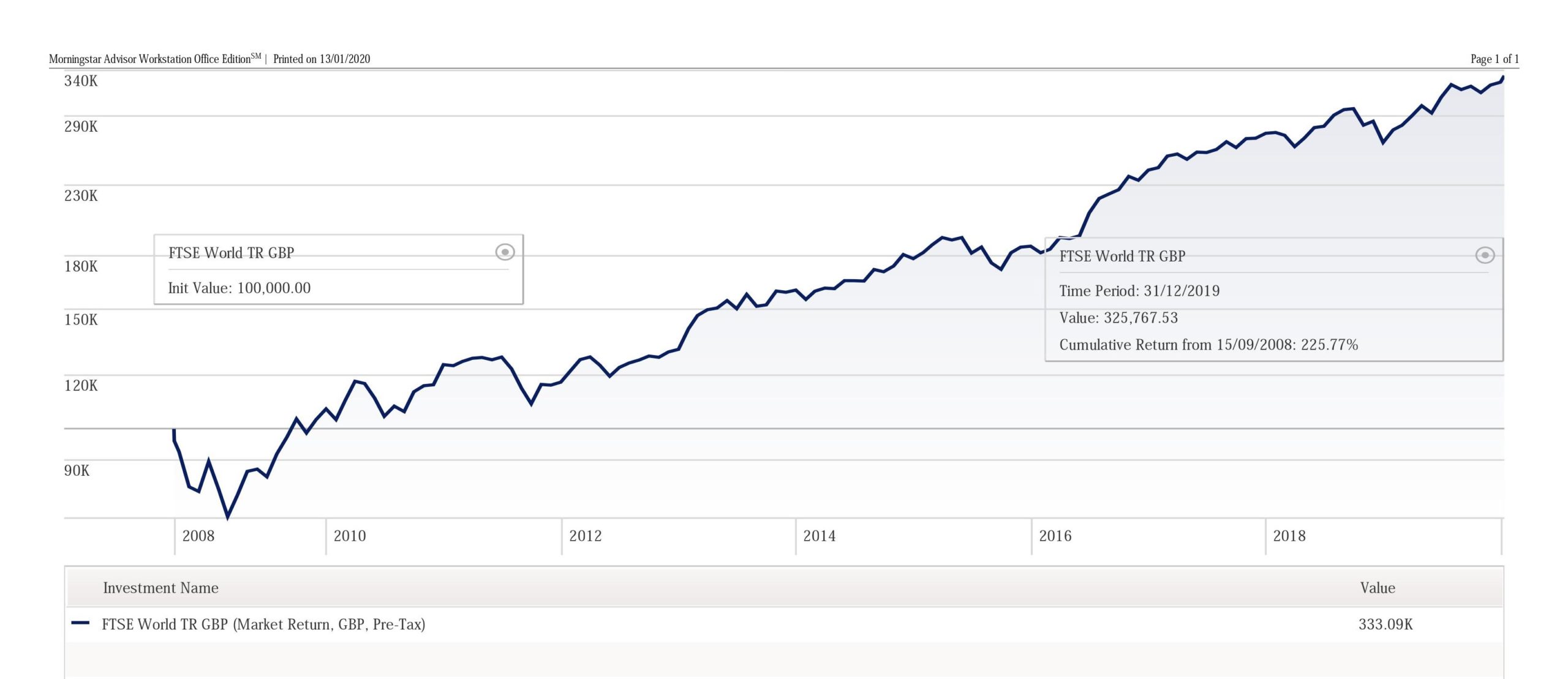

Cash feels so comforting. But even if you’d have been unlucky enough to invest in the global stock market1 on 15th September 2008, the day Lehman Brothers went bust and the Financial Crisis deepened, you’d have initially seen your investment drop something like 25% only to recover and advance. Leading to a total return of 225% at an average of 11% per annum, inclusive of the initial loss. It’s all about the long game.

Triggers

In general, people seek financial planning and investment advice when something significant has changed in their life, needing action. A promotion, an inheritance, a growing family, impending retirement, sale of a business or just the pent up feeling of wanting to get your act together.

You have very little control over the timing of triggers prompting action. Likewise, the need for action rarely coincides with perfect investing conditions.

If you have children, you probably remember discussing whether it was the right time to start a family. You might not have even had that option. But common thoughts include, are we financially secure? What about my career? Am I ready mentally and emotionally?

My own marriage and the birth of our two children coincided with the Financial Crisis. Born in 2008 and 2010, we also moved to a larger home. At a time when there was significant business uncertainty and stress, here we were actively choosing to give up my wife’s self-employed income and take on added financial responsibility.

Our long-term family plans were specific to us at that moment and the timing was of no consequence. It was tough, but we coped.

Is it safe to invest now? I can’t guarantee that it’ll be plain sailing, but I do know that the quest for short-term certainty does not help you achieve long-term financial goals. If you don’t commit now, what else are you going to do? Sit in cash at interest rates below inflation? That’s a sure-fire way to lose money in the long-term.

Follow me on Twitter @AlexandreRiley

1 Represented by the FTSE World TR GBP index. No charges assumed.

2 Between 01/01/10 and 31/12/2019