UK inflation rose by 2.5% in the 12 months to June 2021. In the US the new rate is 5.4%.

The impact of which I found out recently when I went to the local pub for an eye wateringly high £6 pint!

Roll out the media’s widespread inflation analysis, and personal finance articles offering help on how to protect your investment portfolio against inflation.

It’s a hot topic of conversation right now and one that is likely to persist. However, it’s also the type of media focus that prompts investors into making unnecessary changes. Often for the worse.

So, what should you pay attention to, and what should you ignore?

For most people, there are only two truths about inflation you really need to know. The rest is conjecture.

Inflation is your real risk

When it comes to what is called ‘risk’, you should understand above everything else, inflation is your real risk.

The risk of losing money in a stock market crash is a red herring. Incorrectly, it’s what everyone focuses on. As I’ve written before, the ups and downs (volatility) of investing are a feature of the system, not a bug. The ‘risk’ of losing money permanently in a stock market crash can be controlled with good behaviour, goal-based investing, suitable diversification and time.

“The risk of losing money in a stock market crash is a red herring. Incorrectly, it’s what everyone focuses on.”

If you invest sensibly, for the right reasons and for long enough, the ‘risk’ of losing money in the long term can be virtually eliminated.

However, choosing not to invest in the stock market almost certainly risks the loss of future purchasing power, because of inflation. The consequences of running out of money later in life because you can’t afford the higher cost of living is a far greater risk than suffering a stock market loss, which can be recovered in time.

If you expect to live a 30-year retirement on the withdrawals from accumulated savings, investments, and pension pots, you must account for inflation. Not accounting for how destructive inflation is over multiple decades is the mistake most investors make when doing their sums.

“Not accounting for how destructive inflation is over multiple decades is the mistake most investors make when doing their sums.”

A fixed withdrawal from a £1.0m pot at age 60 just won’t buy the same amount of goods and services at age 90, because prices gradually go up. Alarmingly in many cases. Over time you’ll be forced to spend more and more just to maintain the same standard of living.

Think of an example from your own life. 30 years ago, I was a first-year University student and I distinctly remember going to a specific pub with friends for the availability of £1 pints. I wasn’t choosy back then, so some of the price increase in my recent £6 pint can be accounted for by some of that ‘craft beer quality’ I prefer these days (or pretentiousness, depending on your perspective). All the same, in the most recent 30 years, the cost of a pint has increased by as much as 5-fold.

If someone told you today a pint would cost £36 in 2051, you (including me!) just couldn’t imagine it. But it’s not out of the realms of possibility.

You can quickly approximate the number of years it will take for prices just to double by using the ‘Rule of 72’. This rule of thumb also works for inflation. Dividing 72 by the current inflation rate of 2.5 suggests it would take approximately 29 years for prices to double.

On that basis, a 5%, or £50,000 per annum, fixed income withdrawal from a £1.0M pot at age 60, would buy £25,000 of goods and services at age 90. Could you live on half of your proposed retirement income?

If your investments, and the income withdrawals from it, don’t keep up with inflation over time, you’ll end up spending more and more of the principal to make up the shortfall. And as the principal gets smaller the risk is you’ll either run out of money before you die, or you’ll face tough decisions about your expenditure.

No one likes investment volatility, but without it what are you going to do? Stay in cash at 0.10% and live a retirement of compromise, leaving a shrinking inheritance for the kids? Inflation is your real risk, not volatility.

Diversified equities are all you need

When inflation spikes, you’ll see pieces in the newspaper money sections suggesting you invest in gold, alternatives, infrastructure etc. You’ll need an inflation ‘hedge’ apparently. Well no. It’s not necessary, nor worth the time spent deliberating and worrying about. Ignore them.

“You’ll need an inflation ‘hedge’ apparently. Well no. It’s not necessary, nor worth the time spent deliberating and worrying about.”

It’s the perennial ‘here’s an intellectually compelling and overly smart short-term solution, to a long-term problem’. The person proclaiming that they bought gold to ‘hedge’ their inflation risk sounds a lot more ‘in the know’ than the sensible long-term investor who quietly thinks ‘I own a globally diversified portfolio of stocks and bonds, so I don’t have to do anything’. They’re not smarter. They just like to think they are. Ignore them.

The reality is inflation is a constant. It’s something to be accounted for from the outset, not reacted to when it spikes. Over time it ebbs and flows but if your long-term real return (total return, less inflation and costs) is positive, you have little to worry about.

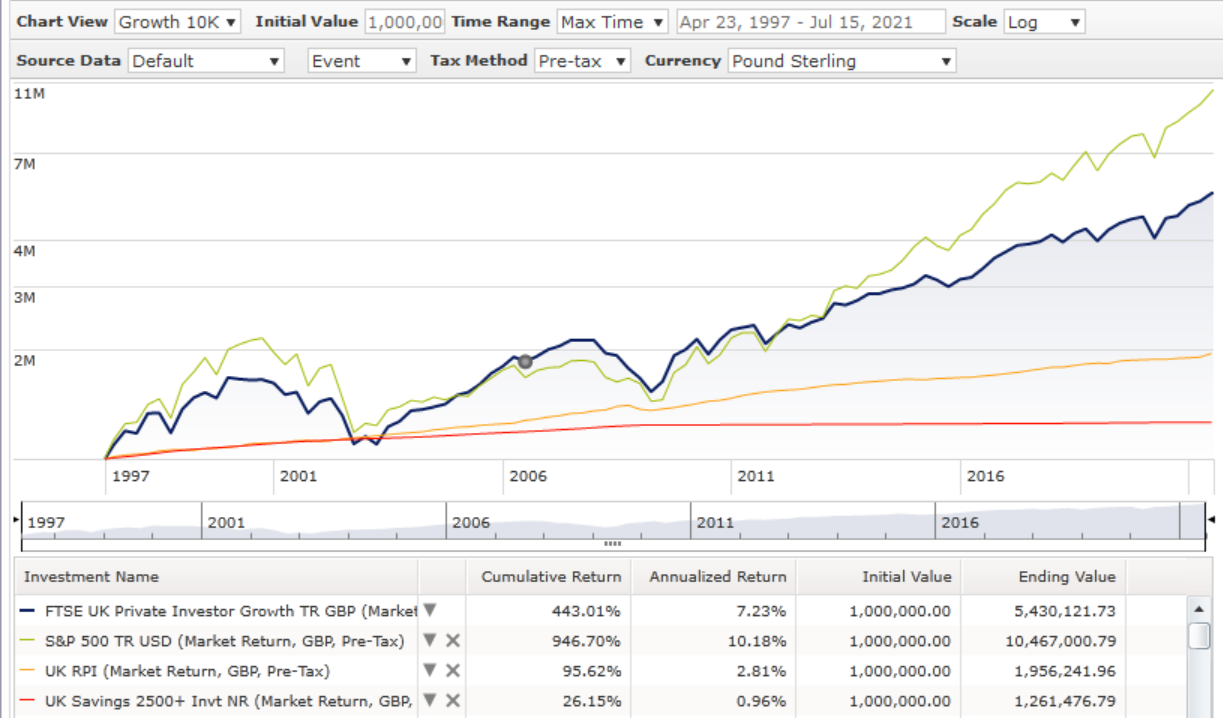

And for evidence, here’s a growth chart comparison for an investor with £1.0m starting in 1997.

- Cash (red) grew to £1.26m at an average interest rate of just under 1% pa

- UK Retail Price Inflation (orange) averaged nearly 3% pa meaning you needed £1.95m in 2021 to maintain the original £1.0m value.

- Investment in the S&P 500 US stock market (green) grew the investment to £10.46m, at an average growth rate of 10% pa.

- A globally diversified ‘Growth’ portfolio (blue) grew the investment to £5.43m at an average growth rate of 7% pa.

These are historic numbers, which are of course not guaranteed to be repeated, but the evidence is clear. The tried and tested method for outgrowing inflation is investing in a portfolio of equities. But if you can’t stand the volatility a 100% portfolio of equities brings (most people can’t), a globally diversified portfolio of stocks and bonds, leaning towards equities, will still do the job, as well as allowing you to sleep a little better at night.

“The tried and tested method for outgrowing inflation is investing in a portfolio of equities.”

It stands to reason, right?

When the price of goods and services goes up, who benefits? Well, the companies providing the goods and services of course! Companies are protecting their profits, which in turn protects their share price. Therefore, equity investing offers natural inflation protection. There is absolutely no need to gamble on anything else!

If you’re a regular reader you already know not to act on short term news when it comes to investment ups and downs. The same goes for inflation. There will be times when inflation runs ahead of, or behind, the Government preferred target. But if you’re invested in a globally diversified equity portfolio, don’t pay heed to the inflation commentary. You don’t need niche investments like gold, which comes with its own risk, to survive a period of excess inflation.

Inflation is your real risk, but it will already be accounted for if you have a sensible investment strategy linked to a sound financial plan.

Follow me on Twitter @AlexandreRiley