This is our blog page where we hope to pass on valuable information, which could help you be better prepared when dealing with your financial arrangements. Whether we explain basic principles, debunk financial myths, or provide general tips, this page is an opportunity for us to share our thoughts which can help you make better financial decisions.

But to be clear. We’re not providing personal advice here (you have to pay for that I’m afraid!) and any arrangements that you make having read these pages are entirely your own affair.

We don’t believe in forecasting the future, and in the event that we discuss specific products, funds or assets here, our opinion should be taken as that, our opinion and not a personal recommendation to buy or sell.

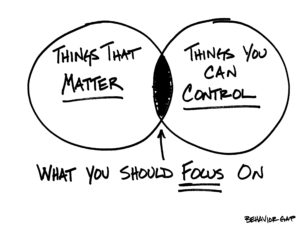

Most investors can’t see the wood for the trees. And the latest hot topic for over-analysis is the potential for rising economic growth, inflation and interest rates to negatively impact Bonds. You all own Bonds via our portfolios, so it’s not irrelevant news. But it is worth understanding why you own Bonds in the first … Continued