Some of you might be wondering about the depth of your exposure to companies on the Russian stock market. Whether you’re worried about the financial impact of being invested in Russian companies or prefer not to from a moral standpoint, I hope this piece will clarify your position.

“Whether you’re worried about the financial impact of being invested in Russian companies or prefer not to from a moral standpoint, I hope this piece will clarify your position.”

But first, let’s put this in perspective. I think we can all agree war is not something anyone wants to see anywhere in the world. And you really don’t need me to tell you here about the atrocities being committed against the people of Ukraine. So, before I continue, you can take it as read that I am appalled by what is happening.

Having made that clear, let me now explain your financial position.

Until last week, Russia was a fully functioning piece of the global investment community. There may have already been good reasons not to invest significant sums there, but companies like Gazprom, Novatek, Sberbank and others were legitimate investment options for equity investment managers around the world.

If you invest in portfolios arranged by Bunker Riley, you should know that we do not recommend investment funds concentrated wholly on the Russian stock market. However, like most investment advisers, our globally diversified portfolios do invest a proportion of client assets in Emerging Market equity funds. Of which Russia is a very small component.

Depending on your agreed ‘Risk Profile’ with us, Emerging Market equity funds will constitute anything from zero to ten per cent of your total portfolio. For ‘balanced’ risk investors, Emerging Market equities represents five or six per cent of your total portfolio.

We’re always trying to manage your exposure to outsized risks. So, for most, if not all our client investors, you’ll have capped exposure to Emerging Market equities via an index tracking fund. A fund of this type invests in Emerging Market countries and companies based on their relative size.

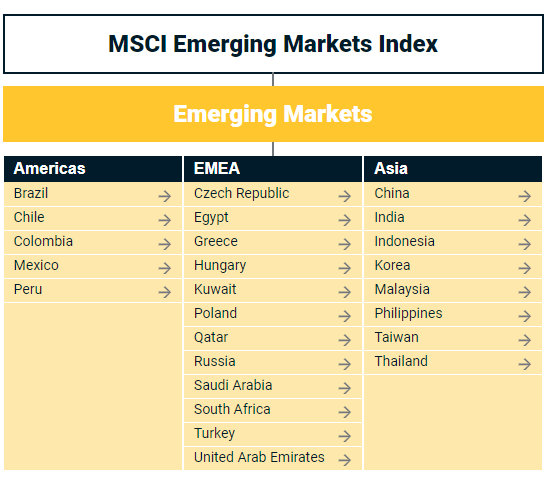

For many index-tracking funds, the MSCI Emerging Markets Index is the foundation upon which the funds invest. The index has an Emerging Market countries list that looks like this:

Source: MSCI

The largest investments are made in China, Taiwan, Korea, India and Brazil. Russian stocks account for approximately 2.2% of the index at present.

Lesson One: Impact on Investment Performance

Clearly, current events have had a negative impact on global stock markets, which had already had a tough start to the year for various other reasons. But war compounds this.

With a ‘balanced risk’ Bunker Riley investor holding approximately 6% of their portfolio in Emerging Market equities, of which only 2.2% is Russian, the net allocation is 0.13% of the total portfolio (6% x 2.2%). This is negligible, and not something to be overly worried by. Clearly, global companies based elsewhere in the world have their own exposures to Russia, which could impact their own business prospects, but Russian stocks in specific are a limited performance risk in our portfolios.

Lesson 2: The Morality of Owning Russian Stocks

You may well say ‘I don’t want to own any Russian stocks’ anymore. And I’d probably agree with you. But that might well end up being the case however you feel.

With sanctions now restricting the trading of Russian equities and bonds in international markets, it’s probable that index providers such as MSCI will be forced to remove the Russian stock market from their index. In fact, pressure is mounting for that to be done immediately. If it does happen, index-tracking funds such as the ones we use, but not necessarily actively managed funds, will remove Russian stocks from your portfolio automatically at the next scheduled index rebalance.

So, whether you’re worried about the performance, or morality of owning Russian stocks, this update hopefully eases any concerns you may have. As is customary, our risk management and planning are completed before the event, and now is the time to do little or nothing.

But if you’re still worried about the impact of recent temporary declines in your portfolio, please do get in touch with me, or read THIS piece, which I wrote during the onset of the Coronavirus pandemic and is well worth reading again.

In the meantime, let’s hope some sense can be found, to avoid more bloodshed in Ukraine.

Follow me on Twitter @AlexandreRiley