Under normal circumstances, I don’t follow or comment on the daily ramblings of the stock market. But on Monday the UK’s stock market (FTSE 100) ended the day up by 5%, and the American market (still open as I write) reached an all-time high.

I write to you today because there is a lesson to be reminded of (again). Market timing is a mug’s game.

“I write to you today because there is a lesson to be reminded of (again). Market timing is a mug’s game.”

These positive stock market surges are on face value a response to the news of a Covid 19 vaccine by pharmaceuticals company Pfizer. It appears President-Elect Joe Biden has solved the Coronavirus problem within 2 days of the election 😉 and stock markets are returning what is for many a year’s return in one day.

But seriously, since the US election last Tuesday the FTSE 100 is up by just over 7%. This is when much of the screaming press prior to the election touted articles on how to play it, fearing further political unrest. Gold they said in many cases. No one saw the news from Pfizer coming.

Now, these gains may or may not hold over the coming weeks, I don’t know, but they are just another reminder of why trying to time an entry or exit from the market is a mug’s game. It just cannot be done with any consistency, and it can’t be traded quickly enough even for clairvoyant retail investors* to benefit.

*JARGON ALERT!

Retail investors = Small fry (relatively). You and me. Invest through slow third-party infrastructure.

Institutional investors = Elephants. Think investment banks and hedge funds. With fast, direct access to the market.

Going back to market timing, you’ve got to make the investment decision which has the highest chance of ending positively, even if from time to time you might take some pain. And when it comes to the stock market, you’ve got to be in it to win it.

“When it comes to the stock market, you’ve got to be in it to win it.”

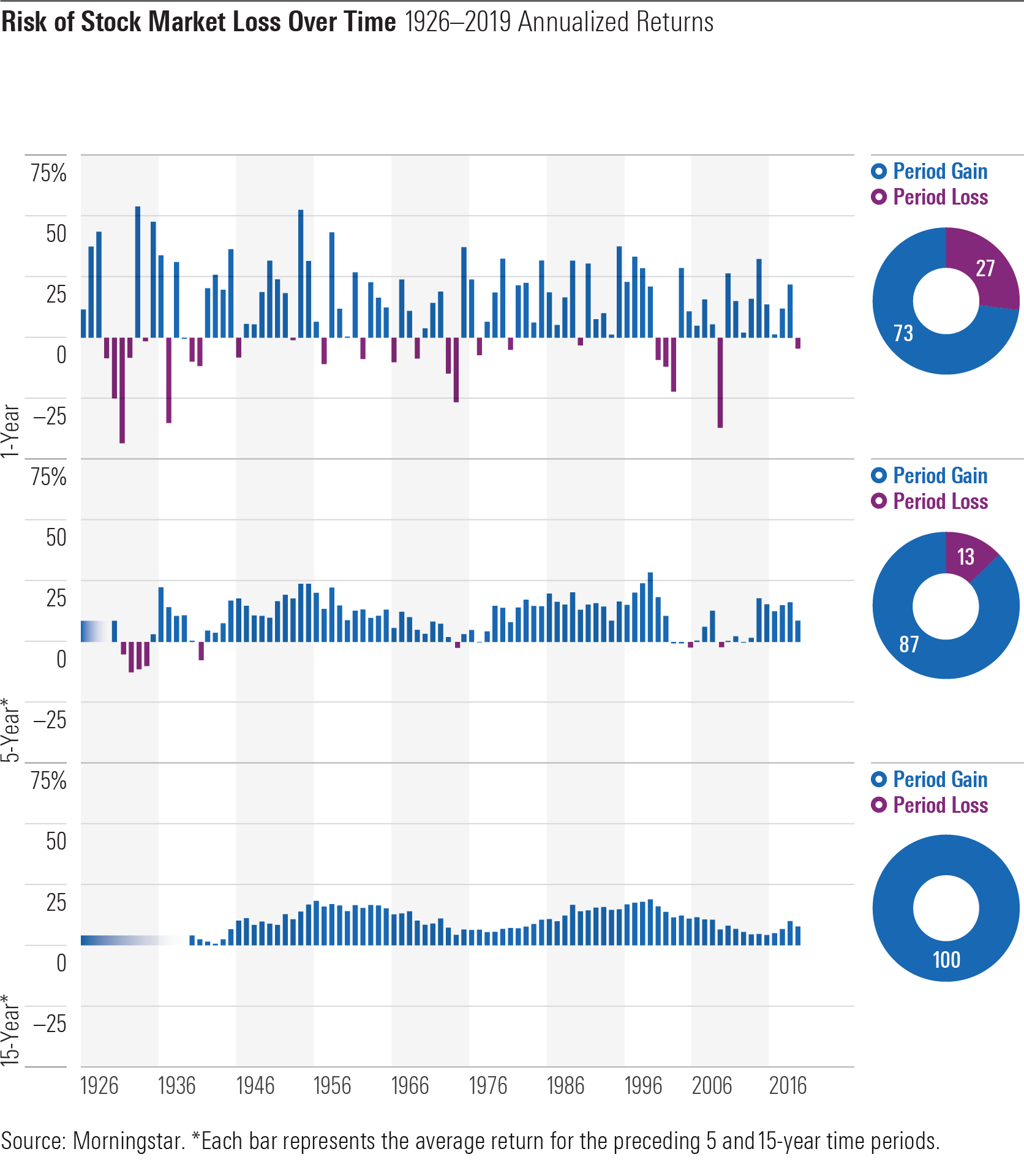

And the data overwhelmingly supports this. If you invest with long-term goals, periods of temporary decline become largely irrelevant. It’s the end game you are interested in. Invest with a 15-year mindset and history says you’re very unlikely to lose.

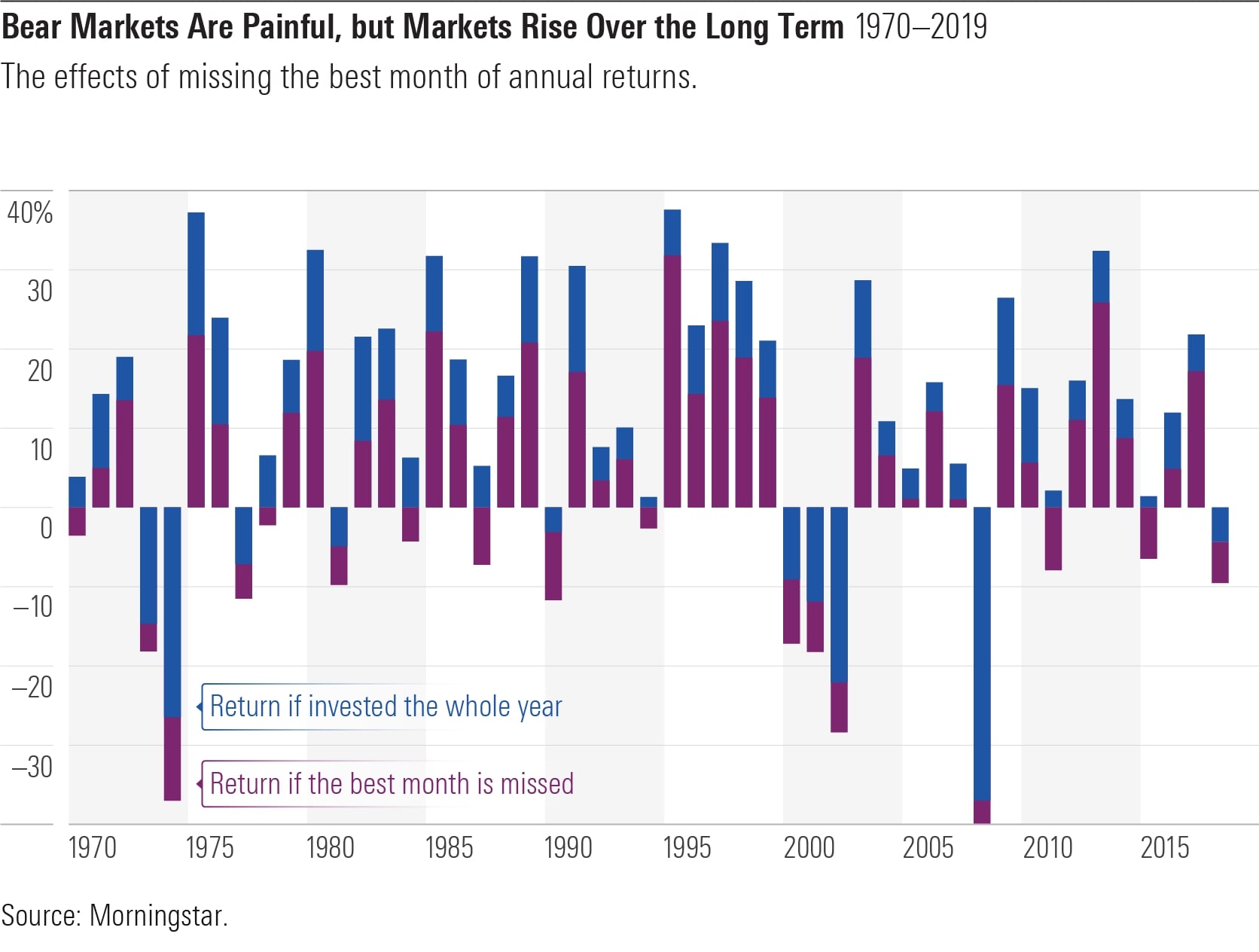

So, if temporary declines become largely irrelevant, why risk coming out on the wrong side of market timing? Short, sharp periods of gain are commonplace. Don’t miss them by being out of the market.

I say congratulations to every single one of our clients, and anyone else for that matter, who didn’t make wholesale changes based on the news during the course of this year. You’re all better off for it today. It’s by no means over, but you might end 2020 with a positive financial outcome.

However, if you’re reading this and your experience has been different, get in touch. I’d be happy to see if we can help.

Follow me on Twitter @AlexandreRiley