Only when something is taken away, do we truly realise its value.

It’s been four weeks since the UK Government introduced the Covid-19 response, suspending our ability to move freely. The expectation is for another month in isolation, maybe more.

It’s needed of course. There are many suffering from medical and financial hardship. But there are things we miss. The pandemic has reminded us of life’s fragility and our need to make the most of it before it’s gone.

With an adaptation period to settle into the new ‘lockdown’ routine under our belts, the general mood as far as I can tell has moved from denial and fear to acceptance and thoughts about the future.

After the Lockdown

A question I’ve seen asked online this week is ‘what will you do when the lockdown ends?’

People are naturally looking forward to better times and the answers to this question have ranged anywhere from ‘hug my mum’ to ‘head straight for my yacht’. Each to their own I suppose. It depends on what is most important to you.

What is clear though is that this enforced period of isolation has caused people to think about the things they might have previously taken for granted. Or the things they had always wanted to do but hadn’t yet.

Whether it’s travel, less commuting, more time with the family, a new vocation or something completely different, we’ve all had a peek at what life is like without options.

Only when something is taken away, do we truly realise its value.

Regret

In a book written by a nurse providing palliative care to those in the last 12 weeks of life, it was observed that the top five regrets of the dying are:

- I wish I’d had the courage to live a life true to myself, not the life others expected of me.

- I wish I hadn’t worked so hard.

- I wish I’d had the courage to express my feelings.

- I wish I had stayed in touch with my friends.

- I wish that I had let myself be happier.

It’s easy to think that we have all the time in the world to get around to the things we really want to do and experience, but the reality is most people don’t.

Maybe in the last few weeks, you’ve thought more clearly about the future and what would need to happen to constitute a happier, more fulfilled life. Maybe you haven’t thought about it all. In that case, I ask you to salvage some good out of this situation by identifying what is most important to you. What makes you happy?

These are the goals upon which your financial plans and supporting investments should be built. How can you arrange your finances and lifestyle to achieve these and avoid future regret?

Your Investments

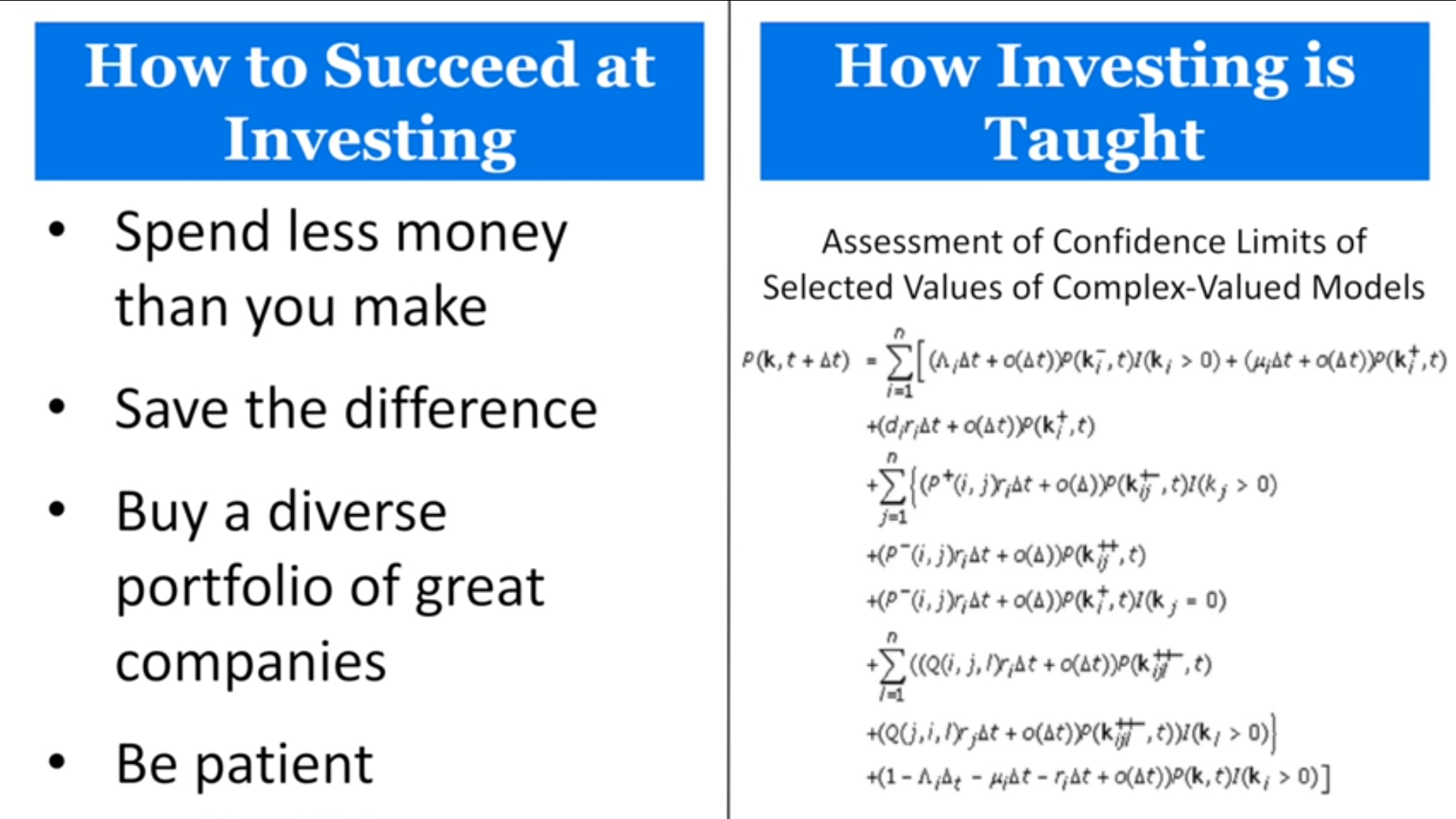

When it comes to the investment tools you need to reach your future goals, financial author Morgan Housel hits the nail on the head with this recent comparison slide.

From day one we’re brainwashed into thinking that to do well from investing we need to find a complex magic formula. If it’s not difficult it can’t be right, right?

That’s rarely the case. Investing doesn’t need to be overly complex in order to meet your identified financial planning goals. In fact, your investments should be boring; it is your life that should be interesting.

“Your investments should be boring; it is your life that should be interesting.”

Consequently, your investment objectives should not be aligned to an arbitrary goal such as beating the index, finding a unicorn investment or using some sort of complex trading formula to prove your intellect.

What truly matters is whether you are on target to meet your identified goals. Risk is measured as the probability that you won’t meet your financial goals. Investing should have the exclusive objective of minimising this risk.

“Risk is measured as the probability that you won’t meet your financial goals. Investing should have the exclusive objective of minimising this risk.” – Butler, Philbrick & Gordillo (from Adaptive Asset Allocation)

So, don’t overthink your investment strategy. When it comes to the investments arranged to support your financial plan, keep it simple. Take the time and stress you save and redeploy it on a plan for life without regret.

Follow me on Twitter @AlexandreRiley