I didn’t watch Love Island.

And until recently I didn’t know much about the former presenter of the show, Caroline Flack. I knew she was a TV presenter. I’d seen her name and face online, but I’d never stopped to read more than the headline if anything at all.

Even so, the ‘breaking news’ of her death in my notifications that Sunday evening was shocking. It felt like a punch in the gut. I’m genuinely sad for her and those close to her. I’m also appalled by the circumstances leading up to someone taking such drastic measures. Parts of the hounding media have a lot to answer for.

Mental health is a primary concern for everyone these days, me included. Now that we have non-stop news, information, commentary and access to other people’s lives through our phones it can be difficult to determine what’s important and what is not.

“Now that we have non-stop news, information, commentary and access to other people’s lives through our phones it can be difficult to determine what’s important and what is not.”

However, I count myself as lucky to have been born with a sunny disposition. I can feel down and have doubts sometimes just like anyone else, but overall, I’m a glass-half-full kind of person. I know that not everyone sees the world this way.

And I know it’s a lot more complicated than just this, but avoiding sensationalist, unrealistic and negative content can only help in keeping you sane.

Although here’s the thing. Most people don’t appreciate that the mainstream financial media are just as bad at providing reasonable, considered content as the other forms of news. Let me remind you to apply the same filtering system and scepticism to financial content.

“Most people don’t appreciate that the mainstream financial media are just as bad at providing reasonable, considered content as the other forms of news. Let me remind you to apply the same filtering system and scepticism to financial content.”

It’s hard though. A lot of financial commentaries appear plausible because of the source, the perceived complexity of the theme or the highbrow analysis. But as someone familiar with the issues, believe me when I say that 95% of mainstream financial content is questionable, irrelevant to your circumstances, blown out of proportion or just outright bullshit.

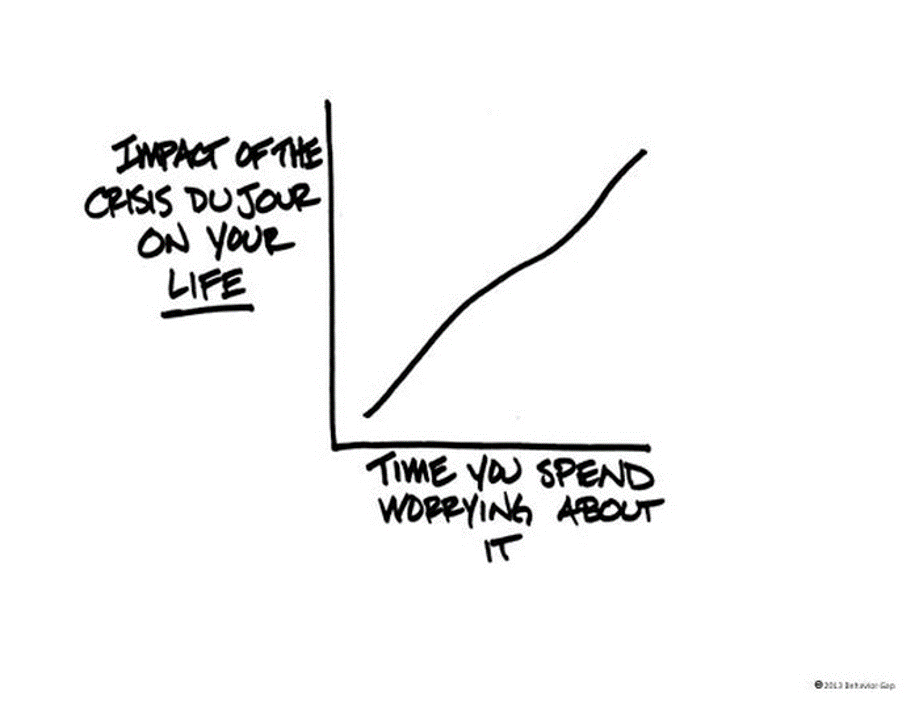

Stick to your own plan. Don’t buy into the doom and gloom that many outlets sell, or you’ll end up making a bad decision. BehaviorGap puts it perfectly in the following sketch from this article.

So be selective about what you read from all disciplines and most of all, #BeKind.

Follow me on Twitter @AlexandreRiley