As you are no doubt aware, the Coronavirus is now a global pandemic. Consequently, the financial media are headlining the news of a decline in the global stock market.

When stock markets turn volatile and confusing as they have done recently, even the most patient investors may come to question the wisdom of their investment plan. I’ve seen a lot of difficult markets come and go since I started advising in 1995 and I certainly understand if some of you find the current environment scary.

So, it is important to remember that stock market corrections and sustained periods of volatility are a common occurrence. It’s a feature of the system, not a bug.

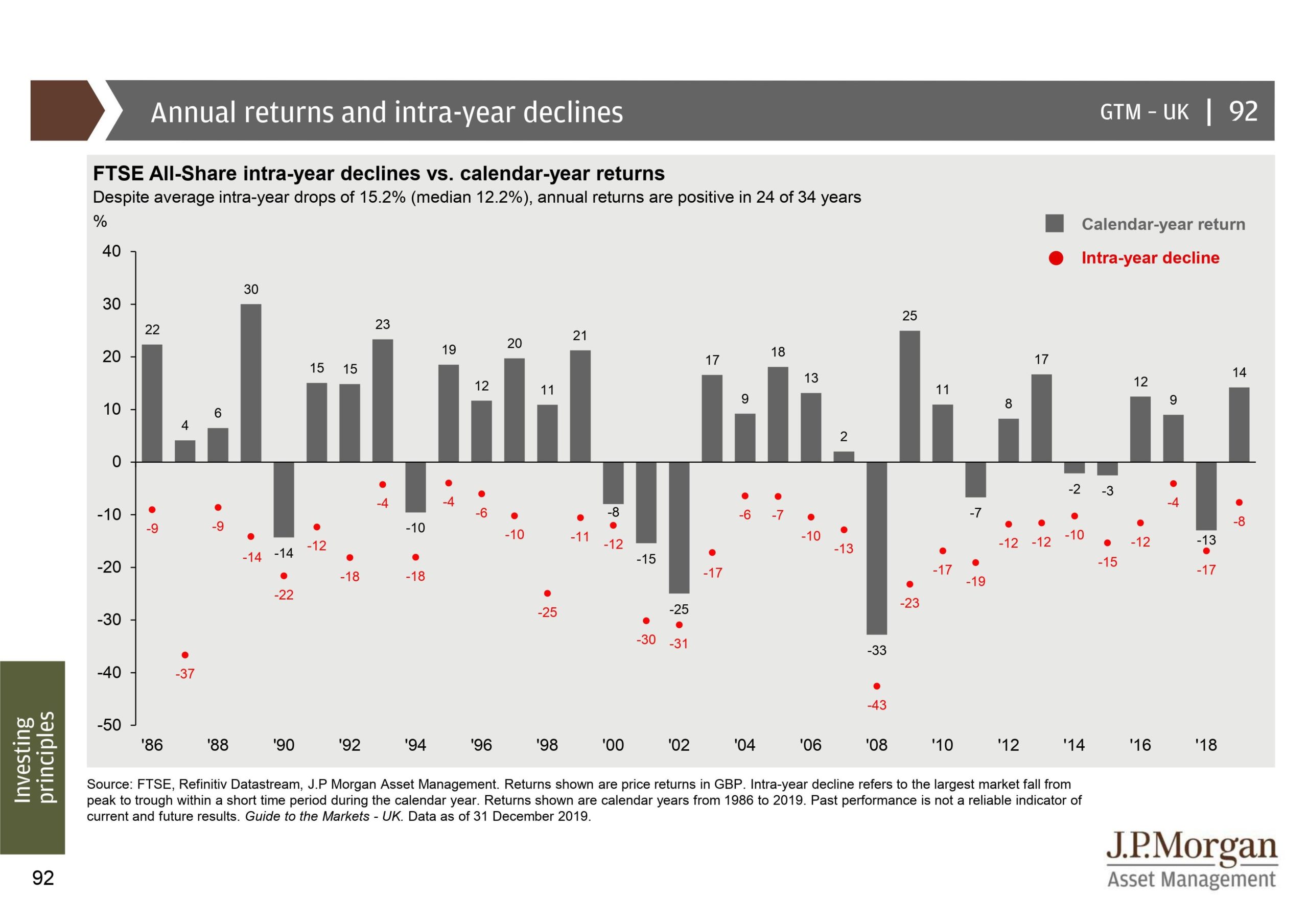

You might not realise it but the average annual top to bottom decline of the UK stock market, the FTSE All-Share, is around -15%. You can see in the chart below that the calendar year return (in grey) is punctuated each and every year with some sort of temporary decline (in red). Most are short-lived with the calendar year still finishing positively.

However, on an average of about one year in five, the stock market experiences a ‘bear market’ closing 20% or more below its previous all-time high.

Neither I nor anyone else can predict when, where or how this ‘bear market’ will bottom out. We can only observe the historical fact that sooner or later, they all have. Therefore, as a long-term investor, you have a choice. Be guided by history or be guided by today’s catastrophic headlines. I choose history.

“Be guided by history or be guided by today’s catastrophic headlines. I choose history.”

Capitulation to a bear market has most often turned out to be a big mistake from which many investors financial plans never recover. At this point you have already endured the risk of a declining stock market and selling now will only lock in a loss that given time is likely to prove closer to the bottom of this market event than you imagine.

As a client of Bunker Riley Financial Planning, you will already own a diversified investment and pension portfolio, which is matched to your agreed risk profile. I remind you here that you do not have all assets committed to the stock market. You have emergency cash reserves and for most of you, stock market exposure is somewhere between forty and sixty percent. For this reason, do not rely on media quoted stock market performance as a guide for your own portfolio.

It is not my job to insulate you from this short-term volatility, but to minimise your long-term regret of not reaching your financial goals. It remains impossible for anyone to know how and when the Coronavirus pandemic will be resolved and how the stock markets will react to a resolution, but based on history, we know that this too will pass.

You would not be human if you didn’t experience some degree of fear at the direction of current events from time to time. But regarding your investments, you must stay the course.

So please try to ignore your investments for the time being and if you’d like to chat with me personally about changes in your circumstances, your financial plans and investment portfolios I’m here if you need me.

Follow me on Twitter @AlexandreRiley

Want more? Read this Flight Turbulence – An Analogy for Stock Market Volatility