Most investors know they should ‘not put all of their eggs into one basket’.

And anyone with a competent financial adviser will have been advised to manage their portfolio ups and downs by spreading investments globally, as well as allocating to different asset classes. The main assets being cash, stocks and bonds.

With stock markets surging forward during the last ten years, the importance of diversification may have been forgotten or even seen as a drag on performance. But the current market decline offers us a reminder of how diversification helps during a difficult time.

Academia has thoroughly documented the theory and benefit of diversification. But this piece is for non-professional savers and investors like you. And in my mind, the key role of diversification is to restrict temporary portfolio declines to an amount that allows you to sleep comfortably at night.

“In my mind, the key role of diversification is to restrict temporary portfolio declines to an amount that allows you to sleep comfortably at night.”

When stocks go through a tricky patch, other assets held in the portfolio can dampen the blow. A diversified 10 to 15% portfolio decline is a lot less scary than 30 to 40%. Diversification should, therefore, help you overcome any urge to sell during a panic, which in most cases is a really big mistake.

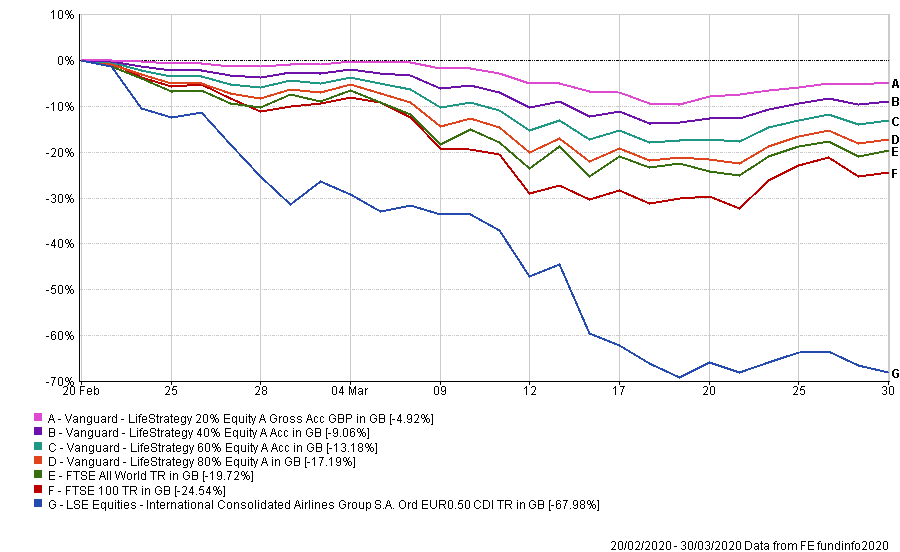

So, with diversification in mind, what has been the investment experience during the recent declines so far? In the chart below you can see the comparative returns of different investments and portfolios1 from the most recent market high (20th February), to date.

Starting with the blue line at the bottom of the chart (G) you can see a decline of -67% incurred on an undiversified individual shareholding of ‘International Consolidated Airlines Group’ or IAG for short.

I’ve used the shares of IAG as a comparison starting point because many investors forget the potential risk of no diversification at all. No company, however large or well known, is immune to losses and who would have thought that the shares of IAG, who own British Airways, could be in trouble?

I’ve seen multiple clients over the years inherit share portfolios of which British Airways (now IAG) was a staple holding. Grandma and grandpa always had a bit of British Airways. It was so big and safe, right? But 67% declines regardless of the company, often lead to giving in to the panic and selling at a significant loss.

And if you do hold on consider this. A -67% loss doesn’t need a +67% gain to get back to where it was. It needs a much larger 203% gain! (£100 declining 67% becomes £33 and to get back to £100 the £33 needs to increase by £67, which would be a gain of 203%)

“Consider this. A -67% loss doesn’t need a +67% gain to get back to where it was. It needs a much larger 203% gain!”

To remove these outsized declines, we diversify. The often-quoted FTSE 100 index represents the UK’s 100 largest companies (F on the chart). We can see that the undiversified IAG share decline is reduced from -67% to approximately -25%. Makes sense, right? One poorly performing share still leaves 99 others, which may be faring better.

But we’re still 100% UK stocks at this point. Diversifying further afield into worldwide stocks (E) reduces the decline to approximately -20%.

And then we can introduce other assets to the portfolio such as bonds, which limits the allocation to worldwide stocks. The chart shows an example range of funds (D to A) which allocate to both stocks and bonds. In these examples, the worldwide stock allocation reduces in each option from 80% to 60% to 40% to 20% with relative investment declines reducing from -17% to -13% to -9% to -5%.

So as can be seen, depending on the diversification and asset allocation applied, declines in these examples range anywhere between -67% to -5% over the same period. Diversification could be the difference between you being metaphorically knocked out, or still standing.

But remember, diversification limits investment returns in both directions, up and down. Protection on the downside invariably leads to constrained growth on the upside. Finding a balance between the long-term average returns needed to achieve a financial planning goal and protection from short-term declines is key.

The chart is intended to show you diversification in the wild, not in a theory. It makes it clear why for most people individual shares, single country only investments and 100% equity portfolios are generally too hot to handle. And remember, these are not minimum or maximum declines. In a pressure environment with no end in sight, being unprepared for declines can lead to panic sales and locked in losses.

Diversification works and it’s your saviour at times like these.

If you’re suffering from declines that you weren’t prepared for, or if you would like to talk to someone about your financial planning and portfolio options right now, please do get in touch. I’d be only too happy to offer you my unbiased opinion.

Follow me on Twitter @alexandreriley

1Indices such as the FTSE 100 and FTSE All-World cannot be invested in directly and incur no charges. Additional charges impact performance further. The use of Vanguard Lifestrategy funds in the chart are for example diversification purposes only and it is not a recommendation to buy. Speak to your financial adviser for advice.