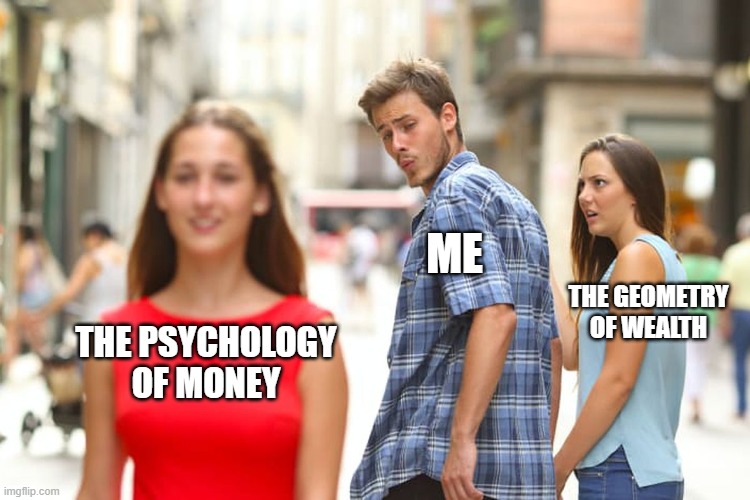

Now and again, a finance book comes along that I think is worth sharing with clients. Released this month ‘The Psychology of Money’ by Morgan Housel, is one of those books.

I’ve read a lot of finance books. Many unfinished. Recommending very few because they’re often too niche, academic or dry. I’m happy to read them because it’s my job, and shhhh, I kind of like it. But you’d be lucky to soldier through any more than the first chapter or two of most finance books.

This book is different. I got through it in 3 sittings.

It isn’t about the technical aspects of money, economics, financial theorem or complex strategies. It’s about people, and how we behave when it comes to money. It’s something we can all understand regardless of our practical knowledge or experience of finance. Because we all understand human emotions.

Housel makes it clear from the outset that financial success is not a hard science. It’s a soft skill, where how you behave is more important than what you know.

“Financial success is not a hard science. It’s a soft skill, where how you behave is more important than what you know.”

You might not appreciate that, yet, but it is the truth. And I have 25 years of client experiences to prove it. In this book, Housel delivers his message in an understandable and relatable way that I only wish I could (however it is his full-time job to write, so you can forgive me that).

In a very readable 220 pages, split into 20 chapters to capture each point quickly, Housel writes what he considers to be the most important, and often counterintuitive features of the psychology of money. Some you might already know, but others will raise your eye and make you look at things in a different way.

For example, when Rihanna nearly went bankrupt her advisor said, “Was it really necessary to tell her that if you spend money on things, you end up with the things and not the money?” Housel goes on to explain that ‘rich’ is current income, and it’s not hard to spot ‘rich’ people. But ‘wealth’ is hidden. It’s income not spent. Wealth is an option not yet taken to buy something later. Its value lies in offering you options, flexibility, and growth to one day purchase more stuff than you could right now. It’s the money you don’t see, in retirement accounts and investment portfolios.

Or the old pilot quip that their jobs are “hours and hours of boredom punctuated by moments of sheer terror”. Relating to the fact that your success as an investor will be determined by how you respond to punctuated moments of terror (financial crisis, Covid-19 pandemic etc.), not the years spent on cruise control.

The other chapters use a similar approach. Take an important concept, weave a relatable story into the explanation and wait for the ‘aha’ moment to take hold. Sounds simple, not easy to do. Housel has a way with words and real-life stories that make the usually academic and dry world of finance relatable and fun. Can I say fun? I think I can in this case.

So, it’s a yes from me. Go get it. It’ll steer you clear of a few mental mishaps that generally lead to poor financial outcomes. And as with my previous book recommendation ‘The Geometry of Wealth’, if you’re a client of Bunker Riley, get in touch, and I’ll send you a copy.

Follow me on Twitter@AlexandreRiley