Most investors can’t see the wood for the trees.

And the latest hot topic for over-analysis is the potential for rising economic growth, inflation and interest rates to negatively impact Bonds.

You all own Bonds via our portfolios, so it’s not irrelevant news. But it is worth understanding why you own Bonds in the first place, so you can make sense of it all.

What is a Bond?

You can make a career out of being an expert on Bonds. But for our purposes, it’s best to keep it basic.

Bonds are effectively loans. If a Government or Company wants to borrow money, it can raise the funds by issuing ‘Bonds’ for sale. The Bond will offer a fixed rate of interest and a set repayment date for the investor (lender).

If an investor buys Bonds, they effectively lend their money to the Bond issuer in return for the interest payments.

But it can get complicated. Some bond issuers are more creditworthy than others, and after buying a Bond the investor can transfer ownership to someone else by selling it, rather than waiting to get their money back at maturity.

And when the bond is sold, the market value can be higher or lower than the original amount invested (loaned). This is because of changes in interest rates, real or anticipated, plus supply and demand.

For example, if a bond is originally issued with fixed interest payable of 2%, and general interest rates go up to 3%, then the original fixed rate doesn’t look so good anymore. The original bond value should fall to compensate. Likewise, if the example interest rate fell to 1%, then the original fixed rate looks pretty good, and the bond value should rise as investors clamour to attain a higher interest rate.

The key here is to understand the inverse relationship between interest rates and the capital value of the Bond. If interest rates rise, bond prices fall, and vice versa.

The Current Narrative

So, back to the recent hot topic of potentially rising economic growth, inflation and interest rates. The current narrative is for recovery from the recent pandemic to be swift, potentially because of pent up demand. It follows that the Government will allow inflation to rise to reduce the real value of the massive debt they have incurred. And eventually, interest rates could rise. This makes sense, but how it actually plays out, how far rates go and over what time frame, is not in my, or anyone else’s crystal ball.

So, as you now hopefully understand, if interest rates do rise, Bond values should fall. Therefore, Bond markets are having a few jitters in anticipation. But it’s all pretty normal if you ask me. Markets, whether equity or bond, price in good and bad news every day. What’s important to remember, is that a bad year in the bond market is like a bad afternoon on the stock market. It’s not a like for like risk of loss comparison.

“A bad year in the bond market is like a bad afternoon on the stock market. It’s not a like for like risk of loss comparison.”

And this is where most investors can’t see the wood for the trees.

By focussing on the relationship between pandemic recovery, inflation, rising interest rates and concluding that Bonds offer the risk of capital decline, investors forget the bigger picture. And the bigger picture is why Bonds are a mainstay of all sensible investment portfolios in the first place. Namely, the insurance they provide.

Why We Own Bonds

High-quality bonds, such as UK Government ‘Gilts’, are at the lower-risk end of the investment spectrum because the borrower, in this case the UK Government, has never defaulted on their loan repayments. Hold the bond to maturity and you’ll get the regular interest payments and the loan is almost certain to be repaid. There are many other factors to consider in between, but unlike shares in companies, which can go bust, a total loss of invested capital in Gilts is almost zero.

The upshot of this is that Bond prices move somewhat independently of stocks, and are less volatile, which provides insurance against equity market downturns.

This is because Bond values tend to rise when stock markets fall, or at least not collapse in value. At times of crisis, stock market sellers reach for the safety of Bonds, pushing up prices. So, owning bonds dampens the overall blow. The diversificating quality of Bonds in a stock portfolio is a classic relationship and one that is rarely overlooked in finance. Diversification using Bonds might be boring, but sensible investors do it because investing is not a form of entertainment.

“Diversification using Bonds might be boring, but sensible investors do it because investing is not a form of entertainment.”

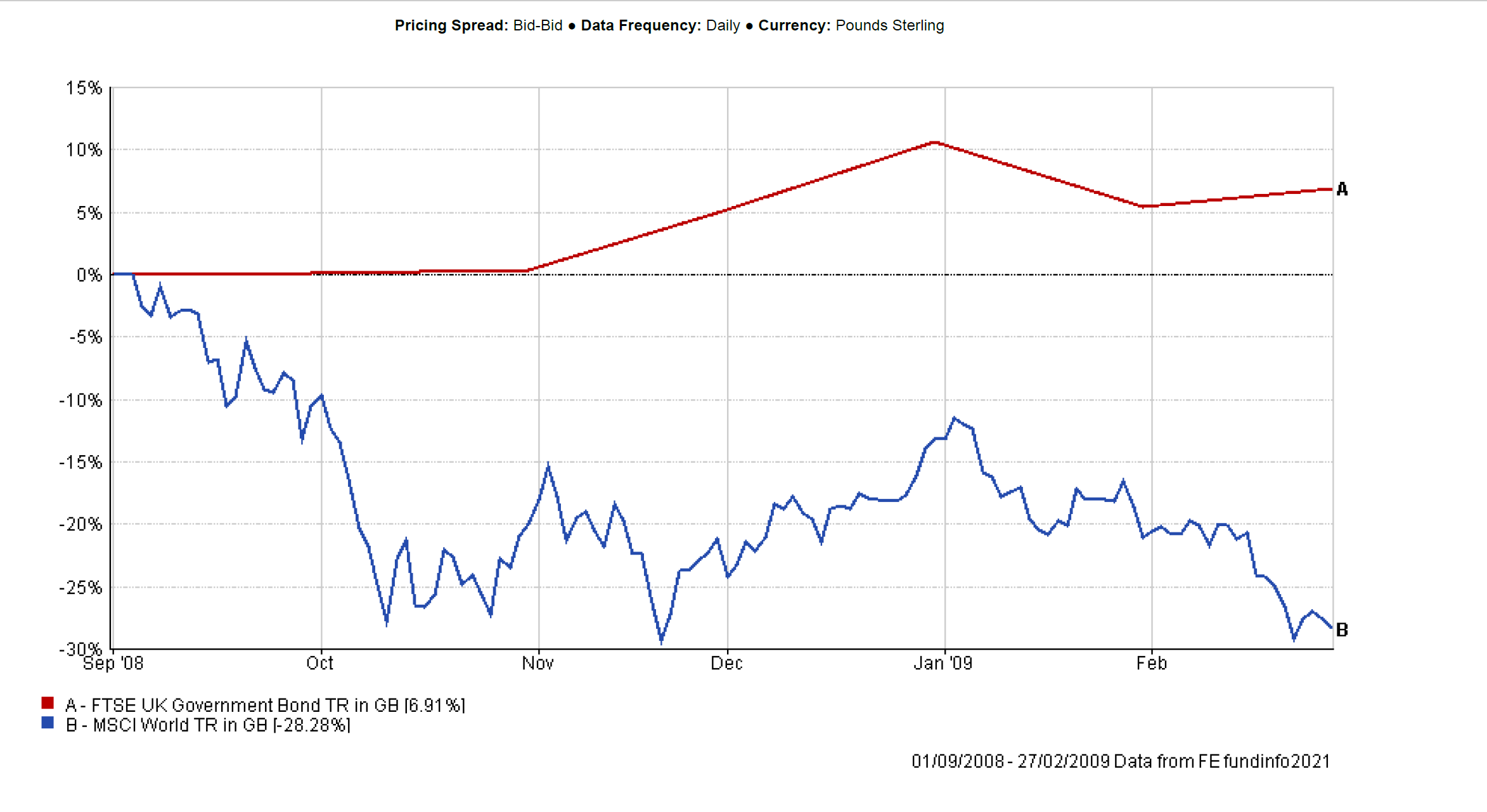

Here’s how stocks and bonds performed during the Financial Crisis 2008-09

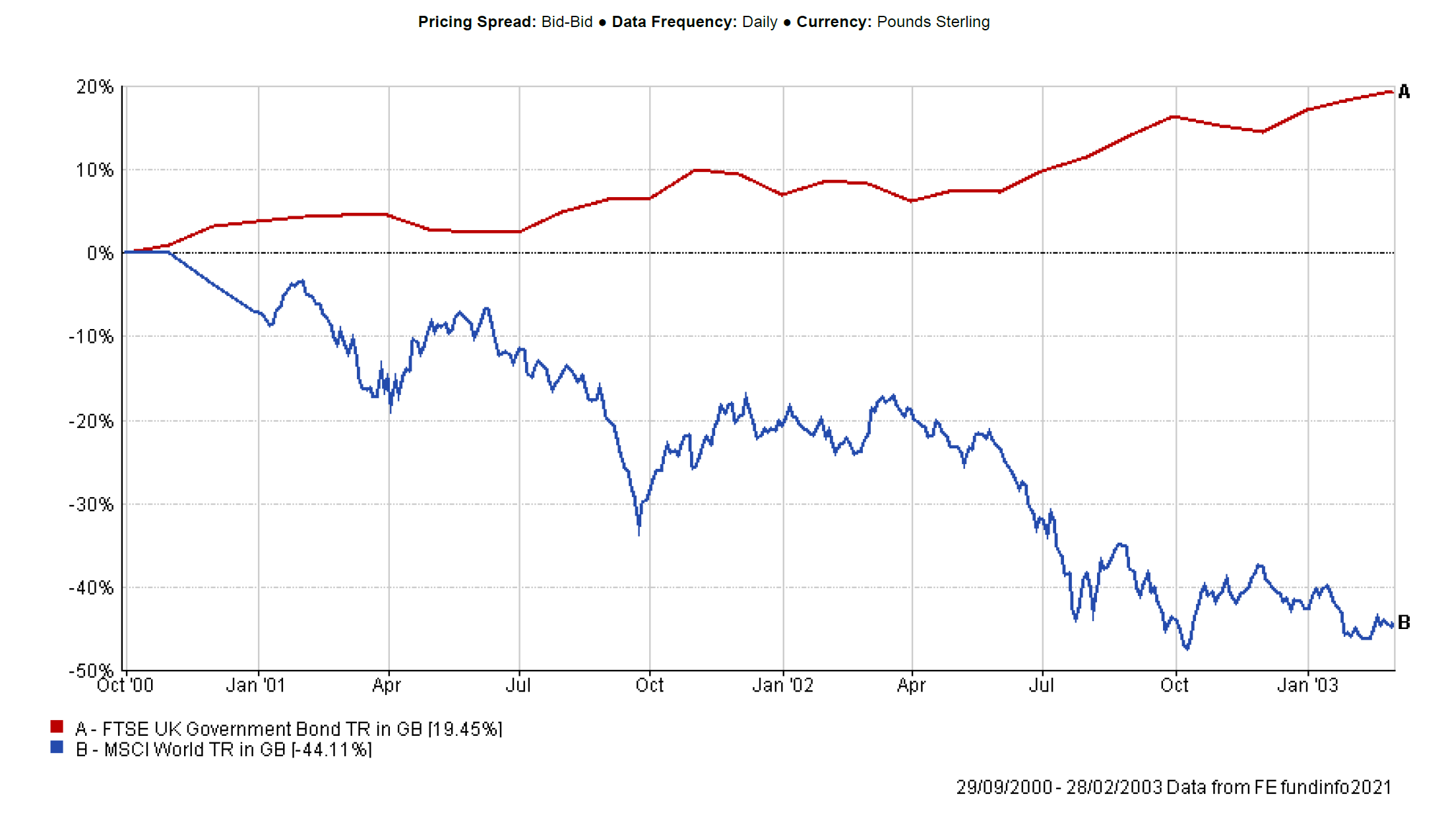

And during the technology bubble crash 2000-03.

When included in a stock portfolio, seen below in green, Bonds offer investors behavioural benefits. Notably, they can help ensure investors don’t make bad decisions when under duress. If a 100% stock portfolio can decline 45% in a crisis, causing sleepless nights and eventually leading to a submission sale to ease the pain. But a 50% equity 50% bond portfolio declines 15% during the same crisis and you don’t sell. Which is worse in the longer-term scheme of things? A lower portfolio return expectation because of holding Bonds, or selling at the bottom of a market decline for a near 50% loss?

And don’t for one-minute kid yourself that in the midst of a full-blown market crisis you’d be immune to it all! The recent pandemic stock market decline and swift recovery is nothing like a drawn-out multi-year bear market, which will test your resolve to stay invested.

So, Bonds are worth more to investors than just their market forecast. You have a bigger picture to consider. The ability to focus on your financial goals and total portfolio (the wood) is far more important than one specific part of the portfolio (the trees).

Follow me on Twitter @AlexandreRiley

One response to “Why Should You Own Bonds?”